A Car Loan Application Letter is a formal request to a bank or financial institution for a loan to purchase a vehicle. Its purpose is to provide the lender with essential information about the borrower, including their financial status and the details of the car they wish to buy. This letter helps the lender assess the borrower’s ability to repay the loan.

In this article, we will share various templates and examples of Car Loan Application Letters. These samples will guide you in writing your own letter. Whether you need a simple request or a more detailed application, we have you covered.

Writing a car loan application can be straightforward with the right tools. Our examples will help you create a clear and effective letter. You can easily customize these templates to fit your needs and make the process smoother.

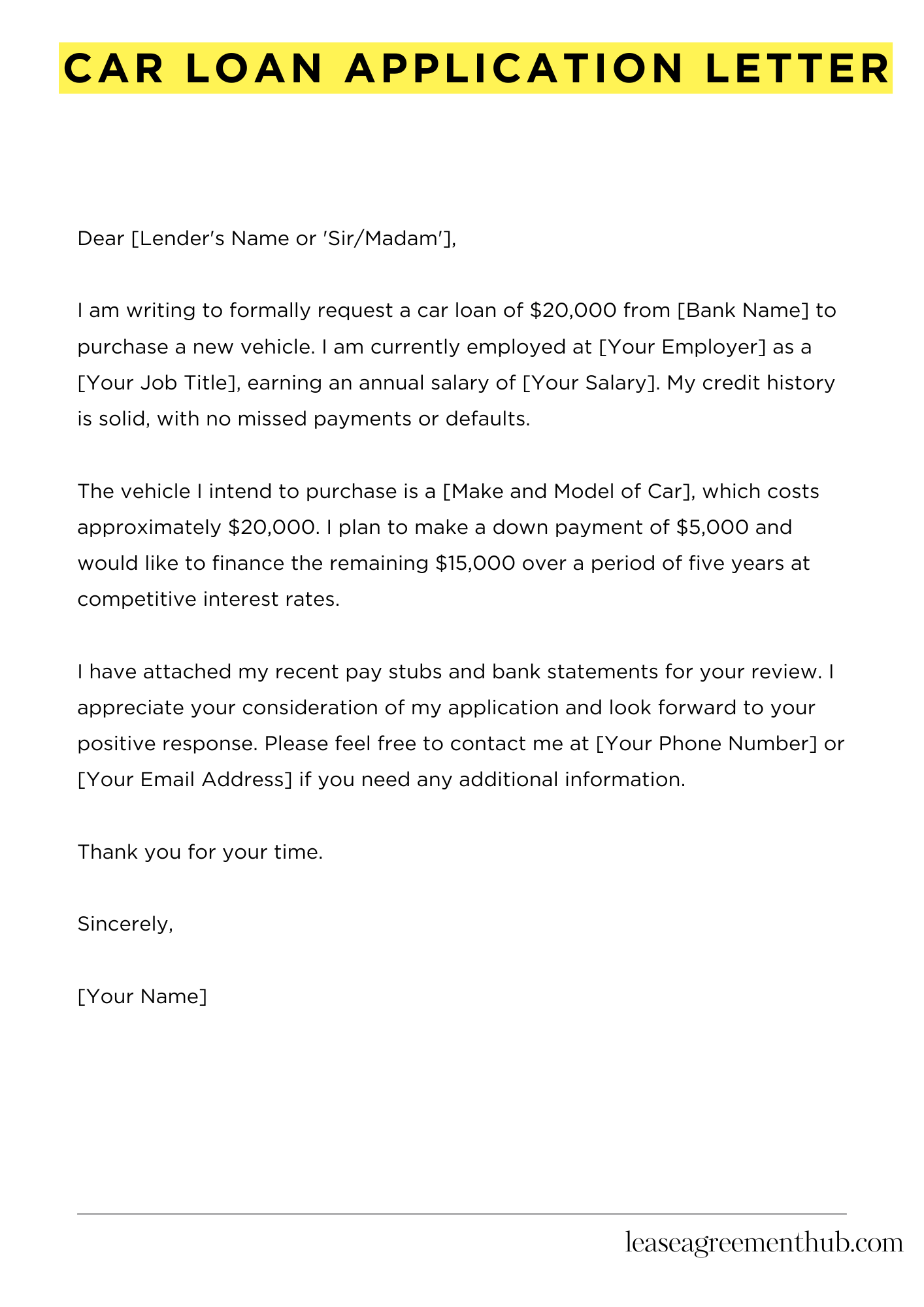

Car Loan Application Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Bank Name]

[Bank Address]

[City, State, Zip Code]

Dear Loan Officer,

I hope this letter finds you well. I am writing to apply for a car loan. I am interested in purchasing a vehicle that will meet my daily needs and improve my commute.

I have researched several options and found a car that I believe is perfect for me. The total cost of the vehicle is [Amount]. I would like to request a loan of [Amount] to help finance this purchase. I am prepared to make a down payment of [Down Payment Amount], which I believe will demonstrate my commitment to the loan.

I have a stable income and a good credit history. My current employment is with [Your Employer] as a [Your Job Title]. I have been with the company for [Number of Years] years. My monthly income is [Your Monthly Income], which allows me to comfortably manage the loan repayments.

I have attached all necessary documents, including my income statement, credit report, and identification. I hope these documents will help you assess my application.

Thank you for considering my request. I look forward to your positive response. Please feel free to contact me if you need any more information.

Sincerely,

[Your Name]

How to Write Car Loan Application Letter

Understanding the Purpose of a Car Loan Application Letter

A car loan application letter is a formal request to a bank or financial institution for funds to purchase a vehicle. This letter serves as an introduction to your application, providing essential information about your financial situation and the car you wish to buy. It is important to convey your need clearly and professionally.

Gathering Necessary Information

Before you start writing, gather all the information you will need. This includes:

- Your personal details: name, address, and contact information.

- The details of the vehicle: make, model, year, and purchase price.

- Your financial information: income, employment status, and any existing debts.

Having this information on hand will make your writing process smoother and more organized.

Structuring Your Letter

Begin your letter with your address at the top, followed by the date. Next, include the bank’s address. Start with a formal greeting, such as “Dear [Lender’s Name]”. The body of the letter should include:

- A brief introduction of yourself.

- The purpose of the letter: requesting a car loan.

- Details about the car you wish to purchase.

- Your financial situation and ability to repay the loan.

- A polite closing statement.

Writing the Letter

Now that you have the structure, it’s time to write. Use clear and concise language. Start with your introduction, explaining who you are and why you are writing. For example:

“My name is [Your Name], and I am writing to apply for a car loan to purchase a [Car Make and Model].”

Then, provide details about the vehicle and your financial background. Make sure to express your willingness to provide any additional information if needed. End with a courteous closing, such as “Thank you for considering my application.”

Reviewing and Sending Your Letter

After writing your letter, take time to review it. Check for any spelling or grammatical errors. Ensure that all information is accurate and clearly presented. If possible, ask someone else to read it as well. Once you are satisfied, print the letter and sign it. Send it to the lender along with any required documents, such as proof of income or identification.

FAQs

What are the key elements to include in a car loan application letter?

Key elements in a car loan application letter include your personal information, employment details, desired loan amount, and vehicle specifics. Clearly outline your income sources and provide any necessary documentation, such as proof of residence and credit history, to support your application.

What should I avoid mentioning in a car loan application letter?

Avoid mentioning any negative financial history, such as past bankruptcies or defaults, unless explicitly required. Do not include irrelevant personal information or emotional appeals. Focus on providing factual and concise information that demonstrates your financial stability and ability to repay the loan.

How can I improve my chances of getting approved for a car loan?

To improve your chances of approval, maintain a good credit score, provide comprehensive documentation of income, and ensure your debt-to-income ratio is favorable. Additionally, consider applying for a pre-approval and shop around for lenders that offer competitive terms tailored to your financial situation.

What are the common mistakes people make in car loan application letters?

Common mistakes include providing incomplete information, failing to proofread for errors, and neglecting to attach necessary documents. Additionally, applicants often underestimate the importance of clarity and conciseness, leading to confusion about their financial situation or loan requirements.

How detailed should my background information be in the letter?

Your background information should be detailed enough to provide lenders with a clear picture of your financial stability. Include relevant employment history, income sources, and any significant financial obligations. However, keep it concise; focus on details that directly support your loan application.

What is the best way to explain my financial situation in the letter?

The best way to explain your financial situation is by presenting clear and organized information about your income, expenses, and debts. Use straightforward language to describe your current job status and any additional income sources. This transparency helps lenders assess your ability to repay the loan effectively.